Everything about Saiyaara — from its star-studded cast and rumored plot to the expected release timeline and behind-the-scenes updates.

Pooja Dadlani manages Shah Rukh Khan's career, branding, and ventures—making her one of Bollywood’s most powerful behind-the-scenes figures.

Asim Riaz’s net worth, cars, and controversies in 2025—find out what’s driving headlines after his exit from Battleground.

Explore Raja Vetri Prabhu’s journey from TikTok to Tamil TV fame, plus his age, wife, net worth, and social media stats.

Hrithik Roshan stuns Americans with his timeless style. Millions Google his name after viral post.

Don't Miss

The best electric scooters in India for students and office-goers with great range, features, and prices.

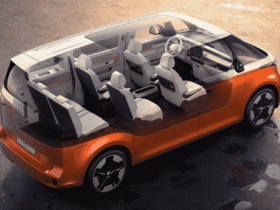

The 10 best-selling foreign cars in India, from luxury to budget-friendly models reshaping Indian roads.

Who’s earning the most on streaming platforms? Explore India’s highest-paid OTT actors and their hit shows.

Business

Dredging boosts Latin America's infrastructure and trade, but faces tech, environmental, and political challenges. Explore its future growth.

How Indian entrepreneurs can adapt OPCs to navigate legal, financial, and operational challenges in today's business climate.

Design workspaces that scale with your business, flexible, future-ready offices by expert interior designers in Surat.

AI agents are reshaping business in 2025 by boosting productivity, streamlining operations, and enhancing customer engagement.

Marketing

Leverage SEO, social media & paid ads to boost your brand in Dubai. Stay ahead with expert digital marketing strategies for 2025.

Elevate your enterprise SEO game with AI-driven tools, automation, and user experience optimization for better rankings in 2025.

Latest Posts

Technology

How to check call history on any number using phone settings, carrier apps, and backups while keeping privacy intact.

Why using an online video translator is vital for global reach, accessibility, and SEO success. Learn how to expand your audience in 2025!

How live casino platforms use AI, blockchain, and APIs to deliver faster, more personalized gaming experiences.

Entertainment

Explore how micro-content and casual gaming are reshaping digital entertainment for busy users with minimal time.

[ruby_related total=5 layout=5]

Active Noon Media is the largest local to national digital media website that represents the voice of the entire nation.